Little Known Questions About Health Insurance In Dallas Tx.

Wiki Article

5 Simple Techniques For Commercial Insurance In Dallas Tx

Table of ContentsThe Greatest Guide To Life Insurance In Dallas TxSome Known Details About Health Insurance In Dallas Tx Little Known Questions About Truck Insurance In Dallas Tx.Some Known Factual Statements About Insurance Agency In Dallas Tx Life Insurance In Dallas Tx Fundamentals ExplainedThe Best Guide To Home Insurance In Dallas Tx

The costs is the quantity you pay (typically month-to-month) for health and wellness insurance coverage. Cost-sharing refers to the section of qualified health care costs the insurance company pays and also the part you pay out-of-pocket. Your out-of-pocket expenses might consist of deductibles, coinsurance, copayments as well as the complete expense of healthcare solutions not covered by the strategy.This type of health insurance coverage has a high insurance deductible that you have to satisfy prior to your health and wellness insurance policy coverage takes impact. These plans can be best for people that desire to conserve money with low regular monthly costs as well as don't plan to use their clinical insurance coverage extensively.

The drawback to this kind of insurance coverage is that it does not fulfill the minimal essential coverage called for by the Affordable Treatment Act, so you may also undergo the tax obligation fine. Furthermore, short-term strategies can leave out protection for pre-existing conditions. Short-term insurance policy is non-renewable, as well as doesn't include coverage for preventative treatment such as physicals, vaccines, oral, or vision.

Life Insurance In Dallas Tx Fundamentals Explained

Consult your very own tax obligation, accounting, or legal advisor rather than depending on this short article as tax, accountancy, or lawful advice.

You can commonly "leave out" any kind of house participant that does not drive your cars and truck, however in order to do so, you need to send an "exemption type" to your insurance provider. Drivers who just have a Student's License are not needed to be listed on your plan till they are totally certified.

The Ultimate Guide To Commercial Insurance In Dallas Tx

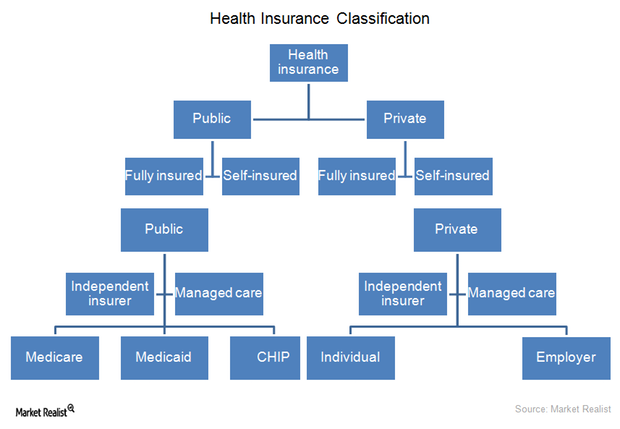

You need to purchase insurance policy to safeguard on your own, your family, and your riches (Commercial insurance in Dallas TX). An insurance coverage can save you thousands of dollars in the occasion of a mishap, ailment, or calamity. As you strike certain life milestones, some policies, including health insurance as well as car insurance coverage, are basically called for, while others like life insurance policy and also handicap insurance coverage are strongly encouraged.click this link Accidents, disease and disasters happen constantly. At worst, events like these can plunge you right into deep economic destroy if you don't have insurance policy to draw on. Some insurance plan are inevitable (think: vehicle insurance in most US states), while others are merely a clever financial choice (think: life insurance policy).

And also, as your life changes (say, you obtain a brand-new job or have a baby) so needs to your protection. Below, we have actually clarified briefly which insurance coverage you must strongly consider purchasing every stage of life. Note that while the plans below are arranged by age, of training course they aren't all established in stone.

Commercial Insurance In Dallas Tx - An Overview

Below's a brief overview of the policies you require and when you require them: Most Americans require insurance to afford healthcare. Choosing the plan that's right for you may take some research, but it works as your very first line of defense against medical financial obligation, among greatest sources of financial obligation amongst consumers in the US.In 49 of the 50 US states, drivers are required to have auto insurance policy to cover any possible home damage and bodily injury that may arise from a crash. Auto insurance policy prices are mostly based on age, credit rating, vehicle make and model, driving document and also area. Some states also take into consideration sex.

Not known Facts About Health Insurance In Dallas Tx

An insurance provider will certainly consider your home's place, along with the dimension, age as well as develop of the home to determine your insurance coverage premium. Houses in wildfire-, tornado- or hurricane-prone locations will certainly generally regulate greater premiums. If you offer your house continue reading this as well as go back to leasing, or make various other living setups (Life insurance in Dallas TX).

For people who are aging or impaired and also need aid with daily living, whether in an assisted living facility or via hospice, long-lasting care insurance can aid carry the excessively high expenses. This is the type of point people do not consider till they age and also realize this might be a fact for them, but of training course, as you grow older you obtain a lot more costly to insure.

Essentially, there are 2 kinds of life insurance policy plans - either term or irreversible plans or some mix of both. Life insurers use various types of term strategies as well as conventional life plans as well as "passion sensitive" items which have actually become a lot more prevalent considering that the 1980's.

The 9-Second Trick For Life Insurance In Dallas Tx

Term insurance coverage offers protection for a specified amount of time. This duration can be as short as one year or offer protection for a certain variety of years such as 5, 10, twenty years or to a specified age such as 80 or in some instances as much as the oldest age in the life insurance mortality.The longer the guarantee, the greater the preliminary costs. If you pass away during the term period, the firm will pay the face quantity of the policy to your beneficiary. If you live past the term duration you had picked, no benefit is payable. Generally, term plans provide a fatality benefit without cost savings component or money worth.

Report this wiki page